#Payroll Firms in Dubai

Explore tagged Tumblr posts

Text

Efficient Payroll Processing Services in UAE

Streamline your payroll with our Efficient Payroll Processing Services in UAE. Ensure accuracy, compliance, and timely payments for your business. Enhance employee satisfaction with our reliable and cost-effective solutions. Maximize productivity by outsourcing your payroll to our expert team.

4o

1 note

·

View note

Text

Enhancing Revenue Through Expert Bookkeeping and Accounting Services by JYWA SETTLERS

Accounting and bookkeeping serve as the backbone of any organization’s financial management system, providing crucial insights into its financial health and facilitating informed decision-making. In today’s globalized economy, the landscape of accounting and bookkeeping has evolved significantly, with the adoption of international financial reporting standards (IFRS) leading to greater standardization and complexity. Against this backdrop, JYWA SETTLERS emerges as a reliable partner, offering specialized accounting services tailored to the unique needs of organizations operating in the United Arab Emirates (UAE).

At JYWA SETTLERS, we recognize the importance of maintaining accurate and up-to-date financial records. Our team comprises certified and expert accountants who are adept at navigating the intricacies of modern accounting practices and compliance requirements. By leveraging our expertise, organizations can rest assured that their financial records are in capable hands, providing them with a solid foundation to manage their business effectively.

Our suite of accounting services encompasses a wide range of functions, including financial statement preparation, general ledger maintenance, and accounts payable and receivable management. We work closely with our clients to understand their specific business needs and tailor our services accordingly, ensuring that they receive personalized solutions that align with their goals and objectives.

In addition to traditional accounting functions, JYWA SETTLERS also offers comprehensive bookkeeping services aimed at providing organizations with real-time visibility into their financial performance. Our team meticulously tracks income, expenses, and cash flow, enabling clients to make informed financial decisions, budget effectively, and forecast future growth.

Furthermore, our professional bookkeeping and accounting services go beyond mere record-keeping. We provide detailed financial analysis and reporting, allowing organizations to gain valuable insights into their financial standing and identify areas for improvement. By understanding the actual financial situation of their firm, clients can implement strategies to optimize revenue, streamline operations, and drive business growth.

In today’s competitive business landscape, organizations cannot afford to overlook the importance of robust accounting and bookkeeping practices. With JYWA SETTLERS as their trusted partner, businesses in the UAE can benefit from our expertise, experience, and dedication to excellence in financial management. By outsourcing their accounting and bookkeeping needs to us, organizations can focus on their core operations with confidence, knowing that their financial affairs are in capable hands.

Accounting services in Dubai

Auditors in Dubai

Best audit firms in Dubai

Auditing companies in Dubai

Accounting & bookkeeping services in Dubai

#accounting services#accounting software#audit firms in dubai#audit firms#audit firms in uae#auditors in uae#cfo services in uae#corporate tax services in uae#financial advisor in uae#vat accountant#bookkeeping#accounting#payroll#financial services#business consulting

1 note

·

View note

Text

Achieving Financial Success with the Best Accounting Firm in Dubai

Your Ultimate Choice for Unmatched Accounting Services in Dubai. As the premier Best Accounting firm in Dubai, we specialize in Business Establishment Solutions, meticulously guiding you through regulations for seamless company formation, ensuring compliance, and maximizing efficiency. Our proficiency extends to Streamlined Visa Processes, simplifying visa procedures and facilitating swift entry into the vibrant UAE market. Moreover, we excel in crafting Efficient Banking Solutions, expediting prompt and hassle-free bank account setups, enhancing the fluidity of your financial operations.

At Nordholm, our forte lies in HR and Payroll Management Excellence, guaranteeing precision in handling human resources and payroll to sustain seamless operations. Additionally, we are experts in VAT Compliance and Financial Precision, delivering accurate accounting services and meticulous VAT compliance management, freeing your focus for core business strategies.

Recognizing the pivotal role of precise accounting in fostering enduring business development, our seasoned team at the Accounting firm in Dubai is dedicated to empowering your journey. We seamlessly harmonize sustainability and reliability, offering expert insights and strategic approaches that empower informed decisions, unveiling new opportunities for your business growth.

Mastering a complicated regulatory web can be tricky, especially in the United Arab Emirates. However, enjoy stress-free business operations with our assistance. Our experience guarantees a smooth journey, freeing you up to focus on ambitiously growing your company's reach.

Choose Nordholm, the unrivaled Best Accounting firm in Dubai, for tailored services committed to your business's triumphs. Our bespoke top-tier services guarantee precise financial reporting and operational efficiency, aligning seamlessly with your unique business aspirations.

#NordholmServices#SMEsDubai#BusinessSetupDubai#HRandPayrollDubai#AccountingFirmUAE#VATCompliance#DubaiConsultingServices

8 notes

·

View notes

Text

Unveiling the Secrets of Corporate Tax Efficiency with Transcend Accounting

At our firm, we specialize in aiding investors to expand their businesses across diverse nations, with a particular focus on the UAE. Our comprehensive services encompass everything from facilitating business establishment in the region—including Company Formation, Visa Procedures, and Bank Account Opening—to Managing HR, Payroll, VAT, Corporate Tax and accounting needs. We provide stress-free and worry-free business services that cater to all the requirements of our investors, ensuring seamless operations and optimal growth.

Strategic Planning: The Backbone of Tax Efficiency

At the core of enhancing corporate tax efficiency lies strategic planning. Our accounting team specializes in crafting bespoke tax strategies that precisely align with the unique needs and objectives of businesses. Through meticulous analysis of financial data and forecasting future trends, we assist businesses in optimizing their corporate tax structure to minimize liabilities and maximize savings.

Leveraging Local Tax Incentives

One of the key advantages of utilizing our accounting's corporate tax services in Dubai is tapping into the array of local tax incentives and exemptions. From free zone benefits to specific industry incentives, we have a deep understanding of the local tax landscape and can guide businesses in leveraging these opportunities to their advantage. By strategically positioning businesses within the appropriate tax jurisdictions, we can unlock significant cost savings.

Technology-Assisted Simplified Tax Procedures In the age of digitization, increasing tax efficiency requires the use of technology. we use state-of-the-art instruments and software to automate tedious work, reduce errors, and expedite corporate tax procedures. By using technology, businesses can save time and money on tax compliance, allowing them to focus on their core operations and key strategic initiatives.

Global Expansion:

Expanding your business globally opens up a world of opportunities, but it also introduces complexities in terms of taxation and compliance. corporation tax services are vital in helping companies who are expanding into foreign markets by offering them the necessary support. These services ensure compliance with tax rules and regulations in numerous jurisdictions and have the experience to navigate the complexities of cross-border taxation.

Peace of Mind:

Businesses can have priceless peace of mind knowing that their tax matters are being managed by appropriately qualified professionals when they use corporate tax services.

Taxation is a complex and ever-changing field, and attempting to manage it internally can be daunting and time-consuming for businesses.

We offer a pathway to financial optimization for businesses operating in the dynamic landscape of Dubai. By employing strategic planning, leveraging local tax incentives, and embracing technology, we empower businesses to maximize tax efficiency and save money. Achieving long-term financial success can be significantly increased by partnering with Transcend Accounting.

So, why not take the leap and explore the advantages of Transcend Accounting's corporate tax services in Dubai today?

#TaxEfficiency#DubaiBusiness#CorporateTax#FinancialOptimization#TranscendAccounting#TaxSavings#StrategicPlanning#TechnologyInTax#TaxIncentives#BusinessGrowth#taxation#uaebusiness#business strategy

3 notes

·

View notes

Text

How to Find a Good Accountant for Your Business

Find Your Best Accounting Partner.

If you're a business owner in Dubai, UAE, you know that managing your finances is an essential part of your operations. It can be overwhelming to keep track of your financial transactions, taxes, and bookkeeping while running your business. Therefore, it's wise to have a competent accountant who can help you with your accounting needs. In this blog post, we will explore how to find a good accountant for your business and the benefits of working with accounting companies in Dubai.

1. Determine Your Accounting Needs

Before starting your search for an accountant, you need to define your accounting needs. Knowing what you require from an accountant will help you narrow down your search. Do you need someone to manage your taxes, bookkeeping, financial statements, or payroll? Do you want a full-time, part-time, or freelance accountant? Once you have answered these questions, you can proceed to the next step.

2. Ask for Recommendations

One of the best ways to find a good accountant is through recommendations from people you trust. You can ask your business associates, friends, family members, or even your lawyer or banker for referrals. They may have worked with an accountant in the past or know someone who has. Alternatively, you can search online for the best accounting firms in UAE or accounting services in Dubai, and check their reviews and ratings.

3. Check Their Qualifications and Credentials

When searching for an accountant, it's essential to check their qualifications and credentials. Look for someone who has a degree in accounting, finance, or business administration. You can also check if they are certified public accountants (CPAs) or chartered accountants (CAs). These designations indicate that the accountant has passed rigorous exams and meets the highest professional standards in the accounting industry.

4. Consider Their Experience and Specialization

Experience is critical when it comes to accounting. You want someone who has worked with businesses similar to yours, understands your industry, and has experience working with different auditing services in Dubai. You should also consider their specialization. Some accountants specialize in tax planning, while others focus on auditing or bookkeeping. Choose an accountant whose expertise aligns with your needs.

5. Assess Their Communication and Interpersonal Skills

A good accountant should have excellent communication and interpersonal skills. You may need someone who can explain complex accounting concepts in simple terms, listens to your concerns, and responds promptly to your inquiries. A good accountant should also be patient, reliable, and trustworthy. You'll be entrusting them with sensitive financial information, so it's crucial to choose someone you feel comfortable working with.

6. Ask About Their Fees

Before hiring an accountant, it's essential to understand their fee structure. Some accountants charge by the hour, while others charge a flat fee or a percentage of your revenue. Ask for an estimate of their fees and what services are included. You should also inquire about additional charges for services like tax preparation, payroll processing, or financial planning.

7. Schedule an Interview

Once you have narrowed down your list of potential accountants, schedule an interview with them. This is an opportunity to ask them questions and learn more about their services. You can also get a sense of their personality and work ethic. During the interview, ask about their experience, their approach to accounting, and how they can help you achieve your business goals.

8. Check Their References

Before hiring an accountant, ask for references from their previous clients. You can contact these clients to learn about their experience working with the accountant. Ask about their level of satisfaction, the quality of their work, and their communication skills. This information can help you make an informed decision when choosing an accountant.

Final Words

In summary, finding a good accountant is an essential step in managing your business finances. By following the steps outlined in this blog post and working with accounting companies in Dubai like A&A Associate LLC you can get the expert financial advice and support you need to succeed in the UAE market!

#accounting companies in Dubai#accounting services in Dubai#Auditing Services in Dubai#accounting firms in UAE

1 note

·

View note

Text

Audit and Accounting Services in UAE | Best Audit and Accounting Services in UAE | Top Audit and Accounting Services in UAE

Introduction

Auditing and accounting services play a crucial role in ensuring the financial health and compliance of companies operating in Dubai. These services help businesses stay on top of their finances, avoid penalties, and make informed decisions to drive growth and profitability.

Auditing Services

Auditing services involve a systematic examination of a company's financial records, transactions, and procedures to provide an independent assessment of its financial performance and compliance with applicable regulations. Auditing services help identify financial risks and provide recommendations to improve financial management, internal controls, and reporting accuracy. In Dubai, auditing services are provided by licensed auditors who are registered with the UAE's Ministry of Economy.

Accounting Services

Accounting services involve the recording, classification, and analysis of financial transactions to prepare financial statements, tax returns, and other financial reports. Professional accounting services can help businesses stay compliant with financial regulations, optimize tax planning, and manage cash flow effectively. Accounting services in Dubai are provided by qualified accountants who are well-versed in the local accounting standards and tax regulations.

Benefits of Auditing and Accounting Services

Businesses in Dubai can benefit from a wide range of auditing and accounting services, including:

• Financial statement audits: Audits of financial statements to provide an independent assessment of a company's financial position and performance.

• Internal audits: Evaluations of a company's internal controls and financial management processes to identify areas for improvement.

• Tax audits: Reviews of a company's tax filings to ensure compliance with tax regulations and identify potential tax savings.

• Forensic audits: Investigations of financial irregularities to identify fraudulent activities and provide evidence for legal proceedings.

• Bookkeeping: Recording and categorizing financial transactions to ensure accurate financial reporting.

• Payroll management: Processing employee payroll and ensuring compliance with payroll regulations.

• VAT compliance: Advising businesses on VAT compliance requirements and ensuring accurate VAT reporting.

• Advisory services: Providing expert advice and guidance on financial management, tax planning, and regulatory compliance.

Partnering with an Experienced Auditing and Accounting Firm Partnering with an experienced auditing and accounting firm can help businesses in Dubai streamline their financial processes, reduce financial risks, and maximize their financial performance. An experienced firm can also provide valuable insights and guidance on financial management, tax planning, and regulatory compliance to help businesses make informed decisions and achieve their financial goals.

0 notes

Text

A Complete Guide to Accounting and Bookkeeping Services in Dubai for SMEs

Accounting and bookkeeping services in Dubai are essential for small and medium-sized enterprises looking to manage their finances efficiently. Proper financial management helps businesses comply with local regulations, avoid penalties, and make informed business decisions. Many SMEs struggle with financial organization, which is why professional accounting services are crucial. These services offer comprehensive solutions, including bookkeeping, tax filing, payroll management, and financial reporting. By outsourcing accounting and bookkeeping services, businesses can focus on core activities while ensuring financial stability.

How to Choose the Best Accounting Services in UAE for Your Business

Selecting the right accounting services in UAE is crucial for business growth. With various service providers available, businesses must consider factors like experience, expertise, and technological capabilities before making a choice. It is essential to work with a firm that understands UAE’s financial regulations and provides customized solutions. Many businesses prefer outsourcing these services to firms with extensive experience in bookkeeping, tax compliance, and financial advisory. The right service provider ensures timely financial reporting, accurate record-keeping, and strategic planning for long-term success.

The Benefits of Outsource Accounting Services in Dubai: Save Time and Money

Outsourcing accounting services in Dubai has become a preferred option for businesses seeking efficiency and cost savings. By outsourcing, companies eliminate the need to hire and train an in-house accounting team, reducing overhead costs significantly. Professional accounting firms provide accurate financial reporting, tax compliance, and payroll management. Additionally, outsourcing ensures that businesses comply with UAE regulations, reducing the risk of financial penalties. Businesses that outsource their accounting operations can focus on expansion, customer service, and profitability without worrying about financial complexities.

Legends Accounting Services: A Trusted Partner for Business Success in UAE

Businesses looking for reliable financial solutions often turn to legends accounting services. These firms offer a wide range of financial management services, including bookkeeping, VAT compliance, auditing, and financial consulting. With experienced professionals handling financial tasks, businesses can focus on growth while ensuring compliance with UAE regulations. The expertise of legends accounting services helps businesses make informed financial decisions, optimize cash flow, and enhance profitability. Partnering with a reputable firm ensures accuracy, transparency, and adherence to industry best practices.

Accounting and Bookkeeping Services Dubai: Ensuring Compliance and Financial Stability

Accounting and bookkeeping services Dubai play a vital role in maintaining financial compliance. Businesses in Dubai must adhere to strict regulations regarding tax filing, payroll processing, and financial reporting. Professional bookkeeping services ensure that financial records are up to date, accurate, and ready for audits. Proper bookkeeping also helps businesses track expenses, manage cash flow, and avoid financial mismanagement. Ensuring compliance with UAE laws protects businesses from legal complications and helps build investor confidence.

Top Accounting Advisory Services to Help Your Business Thrive in the UAE

Accounting advisory services offer businesses strategic guidance to improve financial performance. Professional advisors help businesses plan their finances, manage risks, and optimize their tax strategies. These services are crucial for businesses looking to expand, invest, or improve profitability. By analyzing financial data and market trends, accounting advisory services provide actionable insights that drive business success. Working with an experienced advisory firm ensures that businesses remain financially sound and well-prepared for future challenges.

Accountancy Service in Dubai: Why Every Business Needs Professional Financial Management

A reliable accountancy service in Dubai is indispensable for businesses seeking financial stability. Without proper financial management, businesses may face cash flow problems, tax penalties, and compliance issues. Professional accountants help businesses prepare financial statements, manage payroll, and comply with UAE tax laws. Outsourcing these services allows businesses to focus on core operations while ensuring their financial records are accurate and up to date. Investing in professional accountancy services is a strategic move that guarantees long-term financial success.

The Role of Accounting and Bookkeeping Services in Dubai in VAT Compliance

Since the introduction of VAT in the UAE, businesses must ensure compliance with tax regulations to avoid penalties. Accounting and bookkeeping services in Dubai help businesses navigate VAT requirements, ensuring accurate tax filings and timely submissions. VAT compliance involves proper invoicing, record-keeping, and tax return preparation. Businesses that fail to comply with VAT regulations risk heavy fines and legal consequences. Hiring a professional accounting firm ensures accurate VAT calculations, preventing unnecessary financial setbacks.

How Outsourcing Accounting Services in Dubai Can Improve Your Business Efficiency

Outsourcing accounting services in Dubai enhances business efficiency by allowing companies to focus on their core operations. Managing finances internally can be time-consuming and prone to errors, but outsourcing ensures accuracy and compliance. Experienced accountants use advanced financial software to track expenses, generate reports, and provide real-time insights. This streamlined approach reduces administrative burdens and helps businesses make data-driven decisions. With financial experts handling accounting tasks, businesses can allocate resources more effectively and enhance overall productivity.

FAQs

What are the benefits of outsourcing accounting services in Dubai?

Outsourcing accounting services helps businesses reduce costs, ensure compliance, and improve financial accuracy. Professional firms handle bookkeeping, tax filings, and financial reporting, allowing businesses to focus on growth.

Why is bookkeeping important for businesses in Dubai?

Bookkeeping is essential for tracking financial transactions, managing expenses, and ensuring tax compliance. Accurate bookkeeping prevents financial mismanagement and prepares businesses for audits.

How do accounting advisory services benefit businesses?

Accounting advisory services provide strategic financial insights, helping businesses optimize tax strategies, manage risks, and improve profitability. These services guide businesses in making informed financial decisions.

What should businesses look for when choosing an accounting service provider in UAE?

Businesses should consider experience, industry expertise, technology integration, and compliance knowledge when selecting an accounting service provider. A reliable firm ensures accurate financial management and long-term stability.

Conclusion

Investing in professional accounting services is crucial for businesses in Dubai looking to maintain financial stability, ensure compliance, and enhance profitability. Whether it is bookkeeping, tax planning, or financial advisory, working with experienced professionals streamlines financial management and minimizes risks. By outsourcing financial tasks, businesses can focus on growth while leaving complex accounting responsibilities to experts. Reliable accounting services in UAE contribute significantly to business success, making them an essential component of any company’s operational strategy.

#Accounting Services#Accounting and Bookkeeping Services#bookkeeping and tax services#bookkeeping services

0 notes

Text

How Executive Search in UAE Helps Companies Secure High-Performing Executives

Finding the right leadership talent is crucial for any organization’s success. In a competitive business environment like the UAE, hiring top executives requires a strategic approach. This is where executive search UAE services come in. Companies rely on expert HR consultancy UAE firms to identify, attract, and place high-performing executives who can drive growth and innovation.

Why Choose Executive Search in UAE?

Unlike traditional recruitment, executive search UAE focuses on hiring senior-level professionals who possess the skills and expertise to lead organizations. A specialized executive search agency in Dubai uses advanced search techniques, market intelligence, and an extensive network to find the best candidates for leadership roles.

Key Benefits of Executive Search UAE

Access to Top-Tier Talent Many high-performing executives are not actively seeking new jobs. HR outsourcing services and executive search firms have direct access to these passive candidates, ensuring businesses hire the best talent available.

Tailored Recruitment Strategies A HR consultancy UAE takes a customized approach to hiring, understanding a company’s culture, goals, and leadership needs before shortlisting candidates.

Time and Cost Efficiency Partnering with an executive search agency in Dubai saves companies valuable time and resources. These agencies conduct in-depth assessments, background checks, and skill evaluations, ensuring only the most qualified individuals reach the final selection process.

Confidentiality and Discretion For senior-level hires, maintaining confidentiality is crucial. HR outsourcing companies in Dubai handle executive search with complete discretion, ensuring a smooth and professional hiring process.

The Role of HR Outsourcing Companies in Dubai

In addition to executive search, many businesses in the UAE turn to HR outsourcing companies in Dubai for comprehensive recruitment and workforce solutions. These firms offer:

HR outsource and staffing services for various industries.

Payroll management and compliance solutions.

Training and development programs for employees.

Recruitment process outsourcing (RPO) to streamline hiring.

By working with outsourcing companies in UAE, businesses can focus on their core operations while leaving HR-related tasks to industry experts.

How Executive Search Agency in Dubai Ensures the Right Fit

A executive search agency in Dubai follows a structured process to identify and recruit high-performing executives:

Understanding Business Needs – Agencies work closely with companies to define job roles, leadership expectations, and organizational goals.

Market Research & Talent Mapping – Experts analyze industry trends and identify the best talent available.

Candidate Evaluation & Screening – Candidates undergo rigorous assessments to ensure they meet the job’s strategic requirements.

Final Selection & Onboarding – Businesses receive a shortlist of top candidates, ensuring a smooth transition for the newly hired executive.

Conclusion

For businesses seeking top leadership talent, executive search UAE is the most effective hiring solution. Whether you need C-level executives, senior managers, or specialized leadership roles, a trusted executive search agency in Dubai can help you find the right candidate quickly. Additionally, partnering with HR outsourcing companies in Dubai and outsourcing companies in UAE ensures seamless recruitment and HR operations.

If you're looking for expert HR consultancy UAE, HR outsourcing services, or HR outsource and staffing, reach out to a professional agency today and secure high-performing executives for your organization.

Read More:

Outsourcing companies in UAE | HR outsourcing companies in Dubai | HR outsourcing services | HR outsource and staffing | HR consultancy UAE | Executive search agency in Dubai | Executive search UAE

#Executive search agency in Dubai#Executive search UAE#HR consultancy UAE#HR outsource and staffing#HR outsourcing companies in Dubai#HR outsourcing services#Outsourcing companies in UAE

0 notes

Text

Effective Financial Management with Professional Accounting Services in Dubai

In today's fast-paced business world, efficient financial management is key to success. Whether you're a startup, a small enterprise, or a large corporation, professional accounting support is essential for ensuring regulatory compliance, financial stability, and sustainable growth. If you’re looking for a trusted Accounting Firm in Dubai, AKMC offers a wide range of Accounting Services tailored to meet your business needs.

Why Partner with a Professional Accounting Firm in Dubai?

Dubai's dynamic business environment requires businesses to keep accurate financial records while adhering to local regulatory standards. A professional accounting firm brings expertise in bookkeeping, tax filing, payroll management, financial reporting, and more. With ever-changing tax laws and compliance requirements, an experienced team ensures your business remains compliant and maximizes profitability.

AKMC – Your Reliable Partner for Accounting Services in Dubai

At Arif Kitchlew Management Consultancy (AKMC), we offer comprehensive Accounting Services in Dubai, designed to support businesses of all sizes and industries. Our team of experts delivers customized solutions to help maintain financial transparency, accuracy, and efficiency in your business.

Our Core Accounting Services:

Bookkeeping & Financial Records Management

Detailed transaction recording

Bank reconciliation

Management of accounts payable & receivable

VAT Services & Tax Compliance

VAT registration and return filing

Assistance with tax documentation

Ensuring compliance with UAE tax laws

Payroll Processing

Accurate salary calculations & WPS processing

Employee benefits and deductions management

Outsourced CFO Services

Strategic financial planning & cash flow management

Business performance analysis & reporting

Business Advisory & Consultancy

Financial feasibility studies

Business valuation & due diligence

Why Choose AKMC for Accounting Services in Dubai?

✅ Cost-Effective Solutions – Save on operational costs with our outsourced accounting services. ✅ Compliance & Accuracy – Stay compliant with UAE's financial regulations. ✅ Time-Saving & Efficient – Focus on growing your business while we handle the accounting tasks. ✅ Expert Consultation – Receive personalized financial advice to enhance your business performance.

Get Expert Accounting Services with AKMC

When you partner with AKMC, you're choosing a team of dedicated professionals who are committed to optimizing your financial processes. Whether it's daily bookkeeping, tax advice, or CFO services, we provide customized solutions that align with your unique business needs.

📍 Visit Us: https://maps.app.goo.gl/iLMBoB4AooVEUcXKA 📞 Call Us: (971) 58 590 1930 📧 Email Us: [email protected]

For reliable Accounting Services in Dubai, trust AKMC – your go-to Accounting Firm for efficient and profitable business growth. Contact us today to discuss how we can support your financial needs!

0 notes

Text

Choosing the Right HR and Accounting Services in UAE

In the fast-paced business landscape of the UAE, companies often seek professional support to manage their financial and human resource needs effectively. From small businesses to large corporations, outsourcing accounting services UAE and HR consultancy can provide efficiency, compliance, and strategic growth opportunities.

Importance of Accounting Services

Managing finances is crucial for any business, and professional accounting services help ensure accuracy, compliance, and informed decision-making. Companies in the UAE must adhere to tax regulations, financial reporting standards, and other legal requirements. Hiring experts in this field allows businesses to focus on their core operations while maintaining proper financial records.

Accounting professionals assist with various aspects, including:

Bookkeeping and Financial Statements – Accurate financial records are essential for tax filings and audits.

Tax Compliance and VAT Services – Ensuring adherence to UAE tax laws and avoiding penalties.

Budgeting and Financial Planning – Helping businesses strategize for growth.

Payroll Management – Handling employee salaries, benefits, and tax deductions.

By leveraging specialized expertise, companies can optimize financial processes and improve profitability.

Role of HR Consultancy Firms

A strong workforce is the backbone of any successful organization. Hr Consultancy Firms In Dubai provide businesses with solutions for recruitment, employee management, and compliance with labor laws. Many companies opt for external HR support to streamline operations and reduce administrative burdens.

HR consultancy firms assist with:

Talent Acquisition and Recruitment – Finding skilled professionals to match business needs.

Employee Training and Development – Enhancing workforce skills for improved productivity.

HR Policy Development – Creating policies that align with UAE labor laws.

Payroll and Benefits Administration – Ensuring timely salary processing and compliance with employment regulations.

Outsourcing HR functions allows businesses to focus on strategic goals while maintaining a well-managed workforce.

Choosing the Right Service Provider

When selecting an accounting or HR consultancy firm, businesses should consider the following factors:

Industry Experience – Firms with experience in specific industries understand sector-related challenges and compliance requirements.

Reputation and Client Reviews – Checking feedback from existing clients helps in assessing service quality.

Technology and Tools – Advanced software solutions improve efficiency and accuracy in both accounting and HR processes.

Regulatory Compliance – Ensuring that the service provider is updated with UAE laws and regulations.

Customized Solutions – Businesses should look for firms that offer tailored services based on company size and operational needs.

Final Thoughts

Outsourcing accounting and HR services can help businesses in the UAE achieve operational efficiency, compliance, and financial stability. With professional guidance, companies can focus on growth and expansion without being burdened by administrative challenges. Finding the right service provider ensures smooth business operations and long-term success.

0 notes

Text

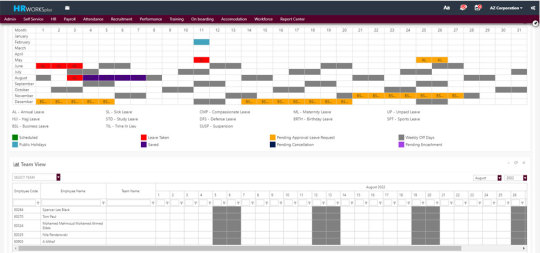

payroll software companies uae

Are you trying to find a straightforward way to handle payments of your employees? DLI-IT Group is here to help. Workforce management is made easier with our HRMS software, HR WORKS. No more challenging spreadsheets or calculations done by hand. Just clear, reliable payroll procedures each and every time. Your HR team will love how easy it is to track working hours along with handling tax withholdings. We've designed our automated payroll software in Dubai to be user-friendly. At DLI-IT Group, we make sure your employee records stay current and accurate. We will adjust our system to meet your company's demands. Our solutions are flexible enough to expand with your business, whether it's a new company or an established firm. In addition, we have the expertise to assist at each step. Speak with us now.

0 notes

Text

Elevate Your Financial Success with Nordholm: Your Go-To Best Accounting Company in Dubai!

Nordholm stands as your ultimate choice for Best Accounting Services Company in Dubai, proudly holding the title of the best accounting company in the region. Specializing in Business Establishment Solutions, we expertly guide you through seamless company formation, ensuring compliance and maximizing efficiency. Our proficiency extends to Streamlined Visa Processes, simplifying procedures for swift entry into the vibrant UAE market. Additionally, we excel in crafting Efficient Banking Solutions, facilitating prompt and hassle-free bank account setups to enhance the fluidity of your financial operations.

We shine in HR and Payroll Management Excellence, guaranteeing precision in handling human resources and payroll to sustain seamless operations. We are also experts in VAT Compliance and Financial Precision, delivering accurate accounting services and meticulous VAT compliance management, freeing your focus for core business strategies.

Recognizing the pivotal role of precise accounting in fostering enduring business development, our seasoned team at the best accounting firm in Dubai is dedicated to empowering your journey. We seamlessly harmonize sustainability and reliability, offering expert insights and strategic approaches that empower informed decisions, unveiling new opportunities for your business growth.

Mastering a complicated regulatory web can be tricky, especially in the United Arab Emirates. However, enjoy stress-free business operations with our assistance. Our experience guarantees a smooth journey, freeing you up to focus on ambitiously growing your company's reach.

Choose Nordholm, the unrivaled best accounting company in Dubai, for tailored services committed to your business triumphs. Our bespoke top-tier services guarantee precise financial reporting and operational efficiency, aligning seamlessly with your unique business aspirations.

#NordholmDubai#BestAccountingCompany#DubaiFinance#FinancialSuccess#AccountingExcellence#BusinessFormation#VisaSolutions#HRManagement#PayrollExcellence#VATCompliance

6 notes

·

View notes

Text

Accounting Services in Dubai: Ensuring Financial Accuracy for Businesses

Dubai is a global business hub known for its strong economy, tax-friendly policies, and supportive business environment. Companies of all sizes operate in this dynamic market, making accurate financial management essential. Accounting Services in Dubai play a vital role in helping businesses maintain financial transparency, comply with regulations, and make informed decisions.

Importance of Accounting Services in Dubai

Every business, whether small or large, needs proper financial management to operate efficiently. Accounting Services in Dubai help businesses manage their finances by recording transactions, tracking expenses, preparing financial reports, and ensuring compliance with local laws. Professional accountants handle these tasks, allowing business owners to focus on growth and expansion.

Financial Accuracy Managing finances accurately is crucial for business success. Professional accountants ensure that all transactions are recorded correctly, preventing errors that could lead to financial losses.

Compliance with UAE Laws The UAE government has strict financial regulations, and businesses must follow them to avoid penalties. Accounting Services in Dubai help companies comply with VAT laws, corporate tax rules, and financial reporting requirements.

Better Decision-Making Businesses need reliable financial data to make informed decisions. Professional accounting services provide clear financial reports, helping business owners plan investments, manage cash flow, and set future goals.

Types of Accounting Services in Dubai

Various accounting services are available to meet different business needs. Some of the key services include:

1. Bookkeeping Services

Bookkeeping involves recording financial transactions such as sales, purchases, payments, and expenses. It ensures that financial records are up to date, making it easier to prepare financial reports.

2. Financial Statement Preparation

Companies need accurate financial statements for tax filings, business planning, and investor relations. Accountants prepare balance sheets, profit and loss statements, and cash flow reports to give a clear picture of a company’s financial health.

3. VAT Accounting Services

Since the introduction of Value Added Tax (VAT) in the UAE, businesses must follow VAT regulations. Professional accountants assist in VAT registration, return filing, and ensuring compliance with tax laws.

4. Auditing Services

Auditing is essential for businesses to verify the accuracy of their financial records. External or internal audits help detect fraud, errors, and financial risks.

5. Payroll Management

Managing employee salaries, benefits, and tax deductions can be complex. Accounting services help businesses handle payroll efficiently, ensuring timely salary payments and compliance with labor laws.

Benefits of Hiring Professional Accounting Services in Dubai

Many businesses in Dubai prefer outsourcing accounting tasks to professionals. Here are the key benefits:

Time-Saving: Business owners can focus on their operations while experts manage financial tasks.

Cost-Effective: Hiring full-time accountants can be expensive. Outsourcing accounting services saves costs while ensuring high-quality financial management.

Expert Advice: Professional accountants provide valuable insights on tax planning, cost reduction, and financial growth.

Accuracy and Compliance: Experts handle financial records with precision, reducing the risk of errors and ensuring compliance with regulations.

Choosing the Right Accounting Service Provider in Dubai

Selecting a reliable accounting service provider is important for business success. Here are some factors to consider:

Experience and Reputation: Choose a firm with a proven track record and positive client reviews.

Range of Services: Ensure the provider offers comprehensive Accounting Services in Dubai, including bookkeeping, tax compliance, and financial reporting.

Industry Knowledge: An accounting firm with experience in your industry will better understand your financial needs.

Technology and Software: Modern accounting firms use advanced software for accurate and efficient financial management.

Transparent Pricing: Look for a service provider with clear pricing and no hidden charges.

Conclusion

Accurate financial management is essential for business growth and compliance with UAE regulations. Accounting Services in Dubai help businesses maintain financial records, comply with tax laws, and make informed decisions. By outsourcing accounting tasks to professionals, businesses can save time, reduce costs, and ensure financial accuracy. Whether you run a startup or a large corporation, professional accounting services can contribute to long-term success in Dubai’s competitive market.

1 note

·

View note

Text

Top 10 Accounting Services in Dubai for Startups: Which Ones Are Worth Your Investment?

The thriving startup community of Dubai calls entrepreneurs from across the globe. However, there is a challenge in dealing with the finances of running a startup in Dubai. This is where accounting services in Dubai become crucial.

The right accounting partner can provide startups with the financial guidance and support they need to focus on growth and innovation. Yet, due to the existence of many accounting firms in Dubai, it can be daunting to pick just the right one.

What to Look for in Accounting Services for Startups in Dubai

Below is an inventory of critical aspects to think about when choosing accounting solutions in Dubai for your business.

Startup Expertise: Find a company with a history of success supporting startups. They should understand the unique challenges faced by young businesses, such as limited resources and fluctuating cash flow.

Service Offerings: The firm shall provide a complete set of accounting services fit for startups, such as bookkeeping, preparation of financial statements, tax compliance, and business advisory services.

Scalability: As your startup grows, your accounting needs will evolve. Select a company that is able to expand its offerings to meet your evolving needs.

Technology: Cloud-based accounting software enables the automation of financial processes and improves collaboration. Look for a firm that utilizes technology effectively.

Communication: Clear and regular communication is essential. Choose a firm that is responsive to your questions and keeps you informed about your financial health.

Cost: Accounting fees may be affected by the type of accounting services that are provided and the complexity of your business. Obtain quotes from a range of companies and analyze their fee structures in order to identify an option that is affordable.

Client Reviews: Read the online reviews and comments of other companies in order to understand how the company is perceived and the quality of the service it offers.

Cultural Fit: Let's discuss the firm's culture and how well it matches the culture and the work style of your startup.

Bookkeeping (often part of the startup accounting package provided by CFO) General Financials Reporting Payroll and Tax Payroll Tax Advice Financial Planning and Analytics Monthly or Annual Financial Statements Analysis Providing Reports to Bankers Due Diligence Tax Strategy.

Accounting firms in Dubai are numerous for startups. Below are some of the considerations to keep in mind when narrowing your choices.

Conduct your own research to find reputable firms in Dubai.

Look for firms with memberships in professional accounting bodies.

Shortlist firms that specialize in working with startups in your industry.

What are the Reasons To Choose Al Zora Accounting Advisory Services For Your Startup's Accounting Requirements In Dubai?

At Al Zora Accounting Advisory Services, we are a team of passionate and experienced professionals dedicated to helping startups in Dubai thrive. We know that there is a specific set of difficulties confronting young enterprises, and we are making a special effort to give you as much financial advice and assistance as will allow you to flourish.

Here's what makes us a perfect partner for your startup:

Startup-Focused Approach: We have a successful record of working with startups in Dubai at different industries.

Comprehensive Services: We provide any and all of the accounting services possible designed for the unique situation of startups.

Scalable Solutions: Our services can scale with your business as you meet your funding checkpoints.

Cloud-Based Technology: We use current cloud storage applications for effective and safe financial accounting.

Proactive Communication: We aim for transparency and constancy in communication by regularly updating you about your fee account.

Competitive Rates: We offer competitive rates for our accounting services.

Contact Al Zora Accounting Advisory Services today to learn more about how our accounting solutions in Dubai can empower your startup for financial success.

Conclusion

Selection of an accounting partner is a significant step for any startup in Dubai. Based on the factors listed above and the study, a firm that matches your needs and budget can be selected. Al Zora Accounting Advisory Services is a guide to your startup's financial challenges in the business environment of Dubai, enabling them to manage for sustainable growth.

0 notes

Text

Accounting Outsourcing in Dubai – Streamline Your Finances with Expert Solutions

Managing business finances efficiently is essential for growth, but handling accounting in-house can be time-consuming and costly. Accounting outsourcing in Dubai offers businesses a cost-effective and reliable solution to manage bookkeeping, tax compliance, payroll, and financial reporting with professional expertise.

By outsourcing your accounting services, you can focus on growing your business while ensuring compliance with UAE financial regulations.

Why Choose Accounting Outsourcing in Dubai?

✔ Cost Savings – Reduce expenses on hiring in-house accountants and investing in accounting software. ✔ Expert Financial Management – Get access to experienced accountants and financial professionals. ✔ Regulatory Compliance – Ensure your business follows UAE tax laws, VAT regulations, and financial reporting standards. ✔ Time Efficiency – Focus on core business activities while experts handle financial tasks. ✔ Scalability & Flexibility – Adjust services based on your business needs, whether you're a startup or an established company.

Key Accounting Services We Offer

1. Bookkeeping & Financial Records Management

Maintain accurate financial records, transactions, and statements for smooth business operations.

2. VAT & Tax Compliance

Ensure proper VAT registration, tax filings, and compliance with UAE tax laws.

3. Payroll Processing

Manage employee salaries, benefits, WPS compliance, and tax deductions efficiently.

4. Financial Reporting & Analysis

Generate detailed financial statements, cash flow reports, and profit analysis for better decision-making.

5. Auditing & Internal Controls

Ensure financial transparency with regular audits and compliance checks.

6. CFO & Advisory Services

Get expert financial guidance to enhance business growth and profitability.

Industries Benefiting from Accounting Outsourcing in Dubai

Our outsourced accounting services in Dubai cater to various industries, including:

Small & Medium Enterprises (SMEs) – Cost-effective solutions for growing businesses.

E-commerce & Retail – Manage inventory, transactions, and tax filings effortlessly.

Construction & Real Estate – Track project expenses, revenue, and compliance.

Healthcare & Clinics – Maintain patient billing, insurance claims, and financial records.

Hospitality & Tourism – Handle payroll, invoicing, and tax filings efficiently.

Why Partner with a Professional Accounting Firm in Dubai?

✅ Certified Accountants – Experienced professionals with expertise in UAE financial regulations. ✅ Secure & Confidential – Data privacy and secure handling of financial information. ✅ Customized Accounting Solutions – Services tailored to meet your specific business needs. ✅ Cloud-Based Accounting – Access financial reports anytime with modern accounting software. ✅ Compliance & Accuracy – Minimize errors and ensure compliance with UAE tax laws.

0 notes

Text

Accounting and Bookkeeping Services in Dubai: A Comprehensive Guide

Dubai is one of the world's leading business hubs, offering a dynamic economic environment, investor-friendly policies, and a tax-efficient structure. Whether you're running a startup, an SME, or a multinational corporation, having a robust financial management system is essential. This is where accounting and bookkeeping services in Dubai play a critical role.

We will explore the importance of professional accounting, key services offered, and why hiring expert accountants in Dubai is crucial for your business’s success.

The Importance of Accounting and Bookkeeping Services in Dubai

Accounting and bookkeeping form the backbone of any business. Accurate financial records ensure compliance with local regulations, facilitate informed decision-making, and enhance overall business efficiency. Dubai’s financial regulations require businesses to maintain proper financial records and submit reports to regulatory bodies. Failing to do so can result in penalties, legal consequences, and reputational damage.

Some key reasons why businesses must invest in accounting and bookkeeping services Dubai include:

Regulatory Compliance: The UAE government has strict financial reporting standards, including VAT compliance and adherence to International Financial Reporting Standards (IFRS).

Taxation Requirements: With the introduction of corporate tax and VAT, businesses must maintain accurate records to ensure timely tax filings and avoid penalties.

Financial Transparency: Well-maintained accounts provide a clear picture of financial health, aiding in budgeting and forecasting.

Fraud Prevention: Regular financial audits help in detecting fraudulent activities and ensuring the integrity of financial transactions.

Key Accounting and Bookkeeping Services Offered in Dubai

Professional accounting services in Dubai cater to businesses across various industries, ensuring smooth financial operations. Some essential services include:

1. Bookkeeping Services

Bookkeeping involves the systematic recording of financial transactions, including income, expenses, sales, and purchases. Proper bookkeeping ensures financial accuracy and helps businesses make strategic decisions based on real-time financial data.

2. Financial Reporting

Timely financial reporting is essential for businesses to track their financial status and comply with regulatory requirements. Reports such as balance sheets, profit and loss statements, and cash flow statements provide valuable insights into a company’s financial standing.

3. VAT Registration and Compliance

Since the introduction of VAT in the UAE, businesses must register for VAT, file returns, and comply with tax regulations. Professional accountants ensure accurate VAT calculations and timely submissions to avoid fines and legal issues.

4. Corporate Tax Advisory

With corporate tax laws now applicable in the UAE, businesses need expert tax advisory services to understand their tax obligations and optimize their tax structure. Chartered accountant firms in Dubai provide guidance on tax planning, ensuring compliance while minimizing tax liabilities.

5. Payroll Management

Payroll processing can be complex, involving salary calculations, deductions, WPS compliance, and end-of-service benefits. Outsourcing payroll management ensures error-free and compliant payroll processing, reducing administrative burdens for businesses.

6. Audit and Assurance Services

Auditing is crucial for verifying the accuracy of financial statements and ensuring regulatory compliance. Chartered accountant firms in Dubai provide internal audits, external audits, and forensic audits to maintain financial transparency and credibility.

7. CFO Services

For businesses that do not have an in-house Chief Financial Officer (CFO), outsourcing CFO services can help in strategic financial planning, budgeting, and risk management.

Why Hire Professional Accountants in Dubai?

Many businesses opt for professional accounting services in Dubai rather than managing their finances in-house. Here’s why hiring expert accountants is beneficial:

1. Expertise and Accuracy

Professional accountants are well-versed in UAE’s financial laws, IFRS, and tax regulations. Their expertise ensures error-free bookkeeping and compliance with local laws.

2. Cost-Effective Solution

Outsourcing accounting services is often more cost-effective than hiring a full-time in-house team. Businesses save on recruitment, training, and overhead costs while accessing high-quality financial services.

3. Time-Saving

Handling financial records, tax filings, and compliance can be time-consuming. Outsourcing allows businesses to focus on core operations while experts manage financial matters.

4. Compliance with UAE Laws

Dubai has strict financial regulations, and businesses must ensure compliance to avoid penalties. Professional chartered accountant firms in Dubai stay updated with changing laws and help businesses navigate complex financial requirements.

5. Fraud Detection and Risk Management

Accountants help in detecting financial irregularities and implementing risk management strategies to safeguard businesses against fraud and financial mismanagement.

How to Choose the Right Accounting Firm in Dubai?

Selecting the right accounting firm is crucial for ensuring financial success. Consider the following factors when choosing a service provider:

Experience and Credentials: Ensure the firm has qualified and experienced accountants who understand Dubai’s financial landscape.

Range of Services: Choose a firm that offers comprehensive accounting and bookkeeping services, including tax advisory, audits, and VAT compliance.

Technology and Tools: A good accounting firm should use modern accounting software for accuracy and efficiency.

Reputation and Reviews: Check client testimonials, online reviews, and case studies to assess the firm’s credibility.

Customized Solutions: Every business has unique financial needs. Opt for a firm that offers tailored accounting solutions to meet your requirements.

Conclusion

In today’s competitive business environment, having reliable accounting and bookkeeping services Dubai is essential for financial success and regulatory compliance. Whether you need bookkeeping, VAT services, payroll management, or corporate tax advisory, professional accountants in Dubai ensure accuracy, efficiency, and compliance with UAE laws.

By partnering with expert chartered accountant firms in Dubai, businesses can streamline their financial processes, reduce risks, and focus on growth. Investing in top-tier accounting services in Dubai is not just a regulatory requirement—it is a strategic move toward sustainable business success.

0 notes